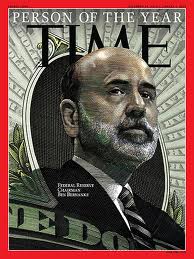

Will Bernanke Taper?

July 21, 2013 7:00 amLast week we touched on some of Fed Chairman Bernanke’s recent comments on Tapering as a solution for the Fed’s plan to exit the market slowly, but surely. The immediate reaction was predictable – similar to what we’ve seen every other time the Fed has suggested a previous strategy to return the market to “normal.”

After seeing this reaction again, Bernanke took last week’s press conference as an opportunity to backpedal from his tapering stance and said that “highly accommodative monetary policy will be needed for the foreseeable future.” The gist of Bernanke’s 2 day testimony this week was that unless the economy meets or exceeds the Fed’s projections, then there will be no tapering. And just like that, the free money was back on the table and the markets were happy again… for the foreseeable future.

This graph simply illustrates the conundrum:

https://pbs.twimg.com/media/BOTlXH3CUAAPjaJ.jpg:large

To make matters more confounding, earnings season is underway and the headline stories all tell proudly how the banks are killing it with profits. Have you seen? Morgan Stanley profits are up 66%… Goldman Sachs, Citi, JPM – all having wonderful returns. Meanwhile wages are flat, debt is at record high levels, and the TBTF banks are all raking it in. What a sad reflectionof QE3.

It is generally not a good sign when the financial sector is the most profitable sector in the entire economy. How do excessive trading profits from TBTF banks translate into growth in the rest of the economy? It would be a far better sign to see improvement in other sectors (such as technology) but that’s not happening.

So for now, it appears that Bernanke and the Fed have painted themselves into a corner. The test attempt at an exit plan produced the expected results, and it became apparent that tapering is still deflationary and is counter to many of the things the Fed wants. Many people continue to ask what Bernanke’s exit plan is. We think his exit plan is to leave his job early next year. If we’re right, the Fed’s plan to exit the markets will be up to the next chairman (or chairwoman, as Janet Yellen seems to be the leading candidate). Only time will tell, but our guess is that they won’t exit any time this calendar year. If they do, the odds are very high that they will have to come back in and increase asset purchases shortly thereafter.

Tags: Bernanke, Fed, TaperingCategorized in: Blog

This post was written by Conscient Capital