Much Ado About Nothing

September 22, 2013 7:00 amWell, well, well… Despite plenty of hints and media hype leading up to the Federal Reserve’s September 18th press conference, it seems as if we’ve just received much ado about nothing. The talking heads were all focused on tapering – most betting on roughly $10B a month – but as the Chairman shared his notes those prognosticators were left scratching their heads.

Mr. Bernanke simply did exactly what he said he would do back in May when he first mentioned the ground rules for tapering. He was clear that any plan to taper would be dependent on the economy meeting or exceeding Fed growth forecasts. In fact, Bernanke specifically stated that a September taper would be data dependent. And what do you know… the data was weak, so QE3 continues.

As usual, the problem back in May was the public heard what they wanted to hear and the media ran with it until they totally convinced themselves it was a sure thing. In fact, the only sure thing was the Chairman’s plan to measure the facts before leading the markets through a season of weaning the federal stimulus that has been in place now for years.

Of course those facts fly in the face of some of the recent headlines suggesting that the “Fed mislead investors” with their news.

Here are two examples: No Taper! Did Bernanke Fool the Street? and Fed Fools Market and Says No Taper

Those may be catchy headlines, but they really don’t tell the true story.

So how about us? We’ll stand by our previous post on this subject – our July 21st blog post stated clearly that we did not believe any tapering would take place anytime soon. In fact, we boldly predicted that Mr. Bernanke would even kick this can down the road and hand this hot potato to his successor.

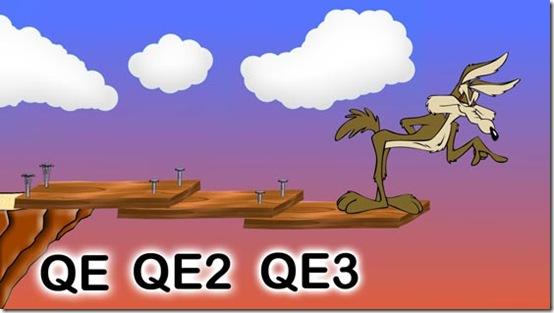

For now it appears that Bernanke and the Fed have painted themselves into a corner. The test attempt at an exit plan produced the expected results and it became apparent that tapering is still deflationary and is counter to many of the things the Fed wants. Many people continue to ask what Bernanke’s exit plan is and we will stick with our previous statement on this subject. Also, keep in mind that the Fed is only aiming at tapering the stimulus, not ending it all together. There’s a big difference between simply taking a little pressure off the gas pedal and actually hitting the breaks. What we now know is that the Fed is not yet ready to even ease off the gas.

Tags: Bernanke, Fed, QE, TaperingCategorized in: Blog

This post was written by Conscient Capital